Everyone knows you need to pay your taxes. If you don’t know this… well, news flash, you should pay your taxes. Most countries have the ability to peer quite deeply into your personal finances, and they will not hesitate to audit you, or at the very least, make you pay taxes years after the taxable transactions occurred.

But how does someone actually do their crypto taxes? In an industry that’s newer and less regulated than traditional finance, and more complicated than income taxes, we need an easy way to track and pay taxes on our crypto holdings.

Whether you’re a HODLer, a trader or a yield farmer, it is crucial to understand how your digital assets are taxed and ensure you’re compliant with tax regulations. In this blog post, we will discuss the details of cryptocurrency taxation and how utilizing specialized crypto tax software can simplify the process.

We’ll explore the benefits of using crypto tax software, common mistakes to avoid, and essential tips for choosing and effectively using these tools to streamline your tax management. Let’s navigate the world of cryptocurrency taxes together and empower you to take control of your crypto taxes with confidence.

Crypto Tax Classifications

In the United States and Australia, crypto is classified as Property and therefore subject to income and capital gains tax. Crypto is recognized as a chargeable asset in the UK, a commodity in Canada, and miscellaneous income in Japan. All of these classifications are also subject to income and capital gains taxes. You can learn more about how crypto is taxed around the world in this Koinly article.

Countries like El Salvador, Malaysia, Singapore and Malta have quite favorable tax regimes and are also crypto-friendly.

Capital Gains Tax

This means that when you sell or dispose of your cryptocurrency, the difference between the purchase price and the selling price is considered a capital gain or loss. Depending on the holding period, these gains or losses can be classified as either short-term or long-term. Short-term capital gains are taxed at a higher rate than long-term capital gains, but if you sell your crypto for fiat at a loss, you can take advantage of what’s called capital losses. These can offset your capital gains for multiple years. Here’s more information on that.

Income Tax

In some cases, cryptocurrencies may also be subject to income tax. If you receive cryptocurrency as payment for goods or services, it is considered taxable income and must be reported on your tax return. The value of the cryptocurrency at the time of receipt determines the amount to be included as income.

But what kind of ‘income’ do crypto transactions provide? This can vary depending on your country of residence, but here are some of the most popular types of crypto income:

- Swaps – swapping one coin for another is unfortunately a taxable transaction, even if the trade doesn’t mean receiving fiat.

- Airdrops – these are considered income and are taxed as such.

- Staking – considered income.

- Yield farming or providing liquidity – if it has an APY, it’s likely income.

- Mining

- Getting paid in crypto – a more obvious one, but important to remember.

- NFTs – selling these is just like selling a token, so it’ll be considered income.

Reporting Requirements

It is essential to understand the reporting requirements for cryptocurrency transactions. Many tax authorities require individuals to report their cryptocurrency holdings and transactions, even if they are not actively buying or selling. Failure to comply with reporting requirements can result in penalties or legal consequences. If you’re using regulated exchanges, such as Coinbase or Robinhood, they’ll provide tax forms! DEX’s like Uniswap, however, will not provide tax forms, but thankfully these crypto tax software platforms will make the record keeping, transaction importing, and preparing of tax forms, a breeze.

Why You Need Crypto Tax Software

Managing cryptocurrency taxes can be a daunting and time-consuming task. The complexities of calculating gains and losses, tracking transactions, and staying compliant with ever-changing tax regulations can overwhelm even the most experienced cryptocurrency investors. This is where crypto tax software comes in. In this section, we will discuss the reasons why using crypto tax software is essential for effectively managing your cryptocurrency taxes.

Benefits of Using Crypto Tax Software – What to Look For

Calculating your cryptocurrency taxes manually can be a complex and error-prone process. With multiple transactions, various cryptocurrencies, and different holding periods to consider, accurately determining your capital gains and losses can quickly become overwhelming. Crypto tax software automates these calculations, ensuring accuracy and saving you valuable time.

Record Keeping

Maintaining accurate records of your cryptocurrency transactions is crucial for tax purposes. It is recommended to keep track of the dates, transaction amounts, and the value of the cryptocurrency at the time of the transaction. These records will help you calculate and report your capital gains or losses accurately.

Many crypto tax software platforms will track all of this for you, after some simple setting up. In the following sections, we will explore how utilizing crypto tax software can simplify the process and ensure compliance with tax regulations.

Automated Data Import

Crypto tax software allows you to seamlessly import your transaction data from various exchanges, wallets, and platforms. Instead of manually entering each transaction, the software automatically retrieves the necessary data, reducing the risk of errors and saving you hours of tedious work.

Real-Time Valuations

Cryptocurrency prices can fluctuate rapidly, making it challenging to determine the accurate value of your holdings at the time of each transaction. Crypto tax software integrates with real-time market data, providing you with up-to-date valuations for accurate tax calculations.

Tax Form Generation

Preparing tax forms, such as IRS Form 8949 or Schedule D, can be a complex task. Crypto tax software simplifies this process by generating the necessary tax forms for you based on your transaction data. This saves you from the hassle of manually filling out complex forms and ensures compliance with reporting requirements.

Tax Optimization Strategies

Crypto tax software often includes advanced features that can help optimize your tax liability. By analyzing your transaction history and applying tax optimization strategies, such as tax-loss harvesting or selecting the most advantageous cost basis method, the software can potentially minimize your tax obligations and maximize your after-tax returns.

Audit Support & Prevention

In the event of an audit or tax inquiry, having comprehensive and well-organized records is crucial. Crypto tax software allows you to generate detailed reports and summaries of your cryptocurrency transactions, providing the necessary documentation to support your tax filings and respond to any tax-related inquiries.

Comparing Top Crypto Tax Software Providers

Once you have identified the key features you require, it’s time to compare different crypto tax software providers. We consider factors like user reviews, reputation, customer support, and pricing. Look for software providers that have a track record of reliability, excellent customer service, and positive user experiences.

Here are our favorites:

Koinly (ref code)

Koinly is a service we personally use here at Dynamo DeFi. Koinly offers 15+ specialized tax reports for over 20 countries, but their claim to fame is that you can import, calculate and generate your crypto taxes in under 20 minutes.

Koinly was founded in 2018, has filed over 11,000 reports, and helps users track over $250 million in their funds.

Koinly tax software is easy and intuitive, and you can also receive expert guidance from real tax consultants.

Koinly pricing ranges from Free to $199 per year. The options are pretty expansive, here’s more pricing information.

Koinly, like many other platforms, is completely free to use – to import wallets, transactions, and track your portfolio, but to generate a tax report you’ll need to at least opt for the Newbie price tier.

Koinly helps the Dynamo DeFi team get a more comprehensive view of our holdings, and is a great double-edged sword to use as a tax tool and a portfolio overview tool.

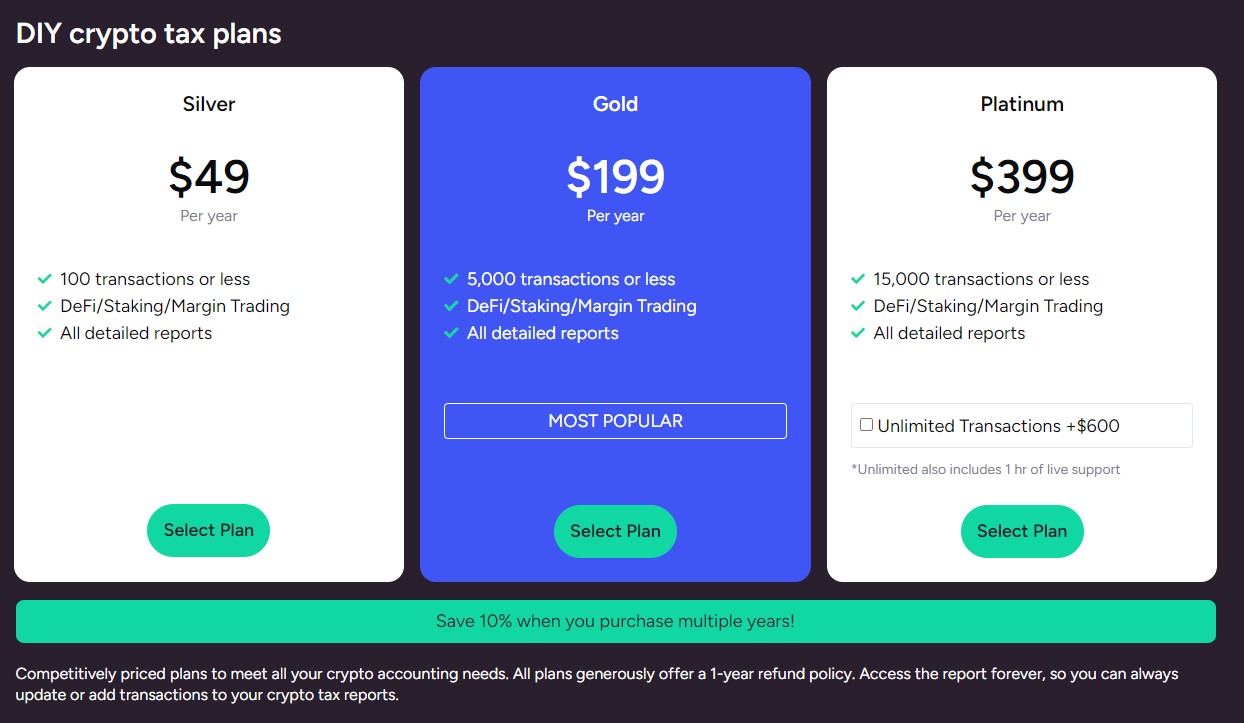

ZenLedger

ZenLedger is a crypto tax software platform that’s been around for quite some time. Members of the Dynamo DeFi team have used it in the past, and had great things to say about the overall experience, specifically ZenLedger’s customer support. ZenLedger’s customer support team is friendly and extremely helpful.

Over the last few years, ZenLedger has raised over $20 million from tier-1 venture capital firms including Mark Cuban’s Radical Ventures and CoinGecko, ZenLedger is trusted by over 100,000 customers, managing $50 billion. If you’re in the United States, you’ll be happy to know that ZenLedger has an easy-as-pie integration with TurboTax.

CoinTracking (ref code)

With nearly 2M users, 25,000 CPA & corporate clients, and 15 years of historical data, CoinTracking is not messing around.

CoinTracking allows you to import trades from over 300 exchanges, and export in more file types than we knew existed. Tax reports can be generated for over 100 countries, with 13 different tax methodologies, and extensive reporting.

They even offer legacy support for defunct exchanges like BlockFi, Celsius, FTX and MtGox.

There are so many detailed reports, this could be your go-to platform for all things crypto, not just taxes. Here’s a helpful video to showcase the different types of reporting available:

You’d think, with all these features, that CoinTracking would be the most expensive competitor in this list, but it’s actually quite affordable – it’s the cheapest option for users that have between 1,000 and 3,500 transactions, and it’s also the cheapest option for anyone who’s importing over 100,000 transactions.

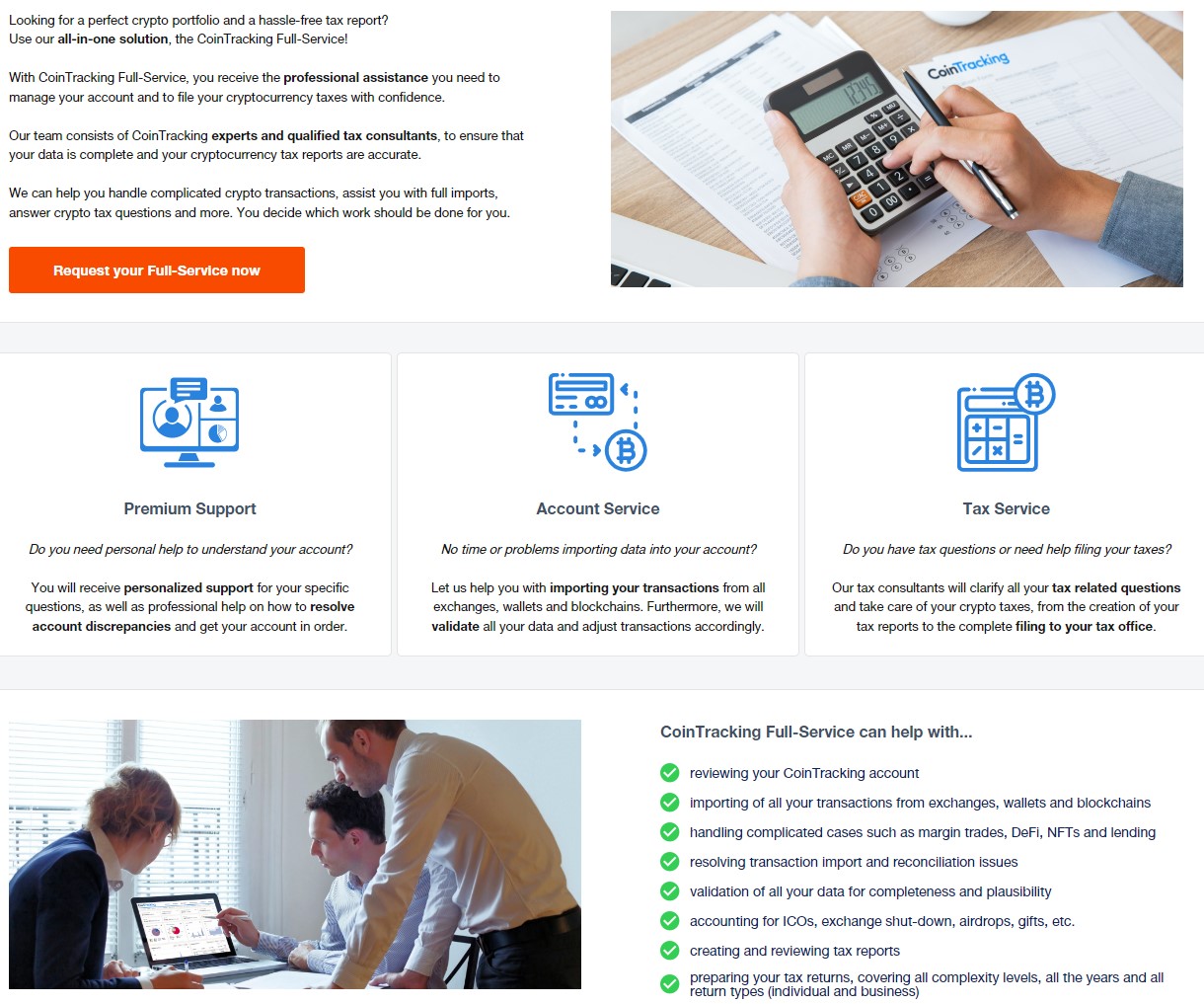

CoinTracking also provides ‘Full-Service’ support option, where you’ll receive professional assistance in managing your taxes and accounts. You get to decide which work you want to do, and which work you want to offload to the CoinTracking team. They offer this service to many countries – not just major markets like the U.S. and U.K.

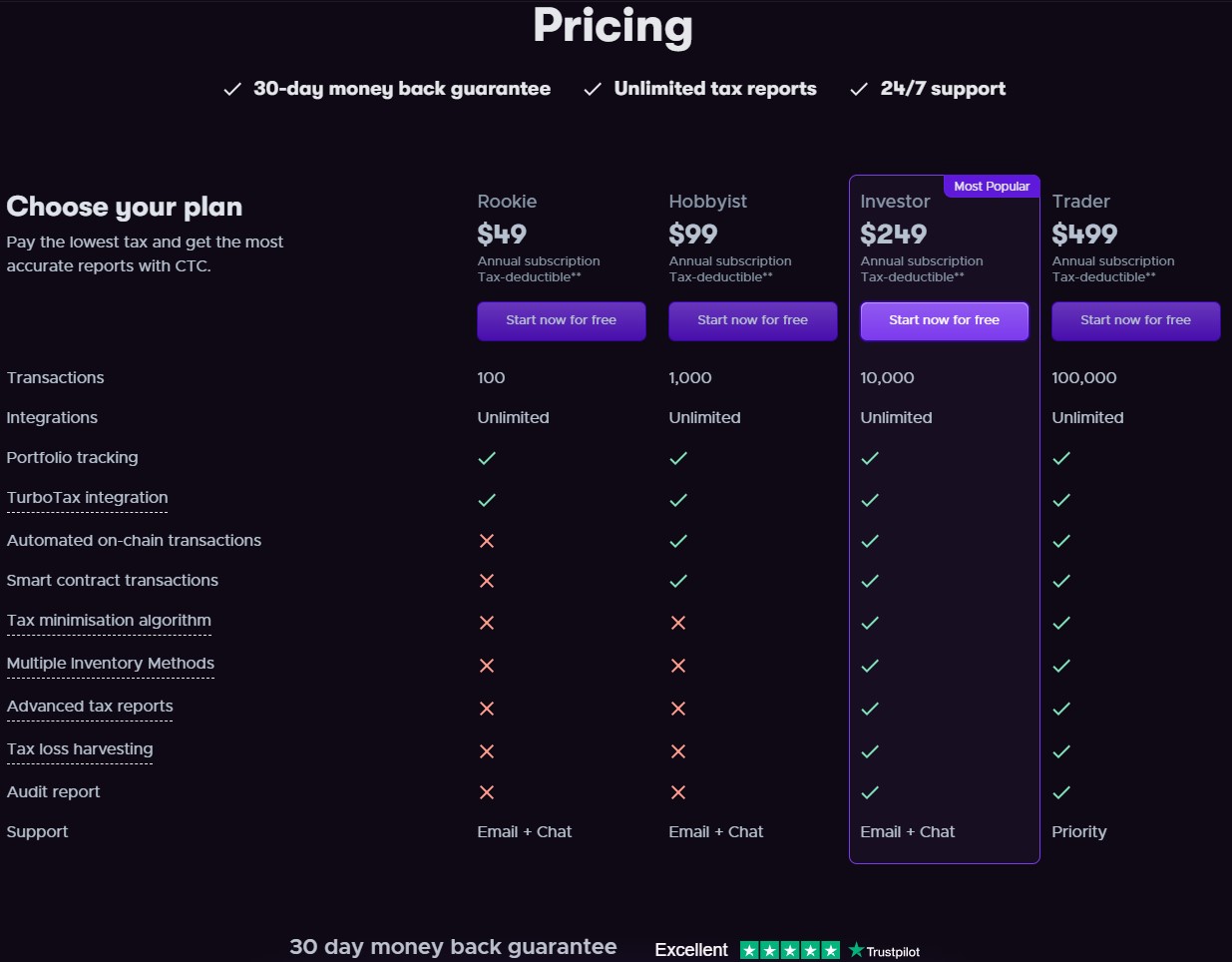

Crypto Tax Calculator (code/coupon available)

Coinbase chose Crypto Tax Calculator as an official tax partner and therefore offers a seamless integration with Coinbase for users. So if you’re a Coinbase maxi, Crypto Tax Calculator is probably the easiest choice for you.

Immediately, Crypto Tax Calculator stands out due to a nice aesthetic and clean UI. It’s probably the prettiest tax tool in this list.

Crypto Tax Calculator makes importing transactions very easy, and touts an AI-powered helper to automatically detect other blockchains on accounts that you’re importing, helps detect spam, and helps you categorize your trades. The platform doesn’t have the most robust portfolio tracker between other competitors but it gets the job done.

You can re-do (or do for the first time if you’re behind) taxes from previous years at no extra charge, but this certainly isn’t the cheapest competitor:

The support team for Crypto Tax Calculator has hundreds of 5-star reviews.

CoinTracker

Not to be confused with CoinTracking, CoinTracker is another easy-to-use tax software that gets you all your reports in minutes.

CoinTracker has a great looking UI with a helpful dashboard that includes your top holdings, value over time (across multiple time frames), a cap gains / income tax summary for each year based on your imports, and overall performance.

CoinTracker has solid reviews from members of the a16z team and Coinbase investors. With 2 million crypto users, over 500 exchanges and wallets, and 20,000 smart contracts, CoinTracker has the infrastructure you need to get the tax man his money without spending too much time or effort. Members of the Dynamo DeFi team currently use CoinTracker and can vouch for the ease of importing and generation of tax reports.

Thanks to $100M in backing from Coinbase Ventures, Kraken Ventures, Intuit Ventures, Y Combinator and others, you can file with TurboTax, H&R Block, or with a personal accountant quite easily:

CoinTracker claims to track over 5% of the entire crypto market, or about $80 billion.

Simplify Your Crypto Tax Burden

Keep Up with Latest Tax Laws

Stay informed about the tax regulations specific to your jurisdiction. Regularly check the official websites of tax authorities or consult with tax professionals to understand any updates or changes in the tax laws related to cryptocurrencies.

Subscribe to reputable cryptocurrency news sources and industry publications. These sources often provide insights into regulatory developments, tax implications, and changes in government policies that may impact cryptocurrency taxation.

Engage with cryptocurrency communities and forums where enthusiasts, traders, and investors share information and discuss tax-related topics. Participating in these communities can help you stay updated with emerging trends and gain insights into how others are navigating cryptocurrency taxation.

Regularly Review and Update Your Transactions

Regularly review your cryptocurrency exchange and wallet accounts to ensure that all transactions are accurately recorded. Check for any missing transactions or discrepancies that may affect your tax calculations.

If you convert cryptocurrencies into fiat currency or vice versa, reconcile your cryptocurrency transactions with your bank statements. This helps ensure that all gains and losses are accurately reported and accounted for.

If you identify any errors or omissions in your transaction history, promptly correct them in your crypto tax software – all of the software tools mentioned in this list make it very easy to change the nature of transactions, or mark them as invisible when converting them into tax forms. This ensures that your tax reports and calculations are accurate, reducing the risk of penalties or audits.

Seek Professional Tax Advice

Cryptocurrency taxation can be complex, and seeking guidance from a tax professional who specializes in cryptocurrencies is highly recommended. You can find tax professionals that specialize in crypto in many of the tools we’ve highlighted. They can provide personalized advice based on your specific circumstances and help ensure compliance with tax laws.

A tax professional can help you identify tax planning strategies to optimize your cryptocurrency tax liability. They can provide insights into tax-efficient investment strategies, deductions, and credits that may be available to you.

In the event of an audit or tax inquiry, having a tax professional by your side can provide valuable support. They can assist in responding to inquiries, preparing documentation, and representing you during the audit process.

Conclusion

Filing cryptocurrency taxes can feel overwhelming, but using crypto tax software can make it much easier. In this blog post, we’ve covered the basic essentials of crypto taxation, highlighted the benefits of tax software, and offered tips for choosing the best tool for your needs.

With crypto tax software, you can automate the calculation of your capital gains and losses, seamlessly import transaction data, and generate precise tax reports. Features like real-time valuations, tax optimization strategies, and audit support can greatly simplify your tax management, saving you time and reducing your tax burden.

Remember, while crypto tax software is a helpful tool, it’s essential to understand tax regulations and stay compliant. Regularly review and update your transactions, keep up with the latest tax laws, and seek professional tax advice when needed.

By following the guidelines in this post, you can confidently tackle your cryptocurrency taxes. Choose a reputable crypto tax software provider, set it up correctly, verify your transaction data, and stay informed about tax regulations and updates.

Simplifying your crypto tax management ensures compliance and gives you peace of mind, allowing you to focus on your investments and financial goals. Embrace the power of crypto tax software and take control of your cryptocurrency taxes today!